Tech stocks have helped power indices higher in the past several months, with the mega-caps continuing to dominate until recently. One area of the tech arena that’s not performed as well in the past couple of months is software, which has faced a long consolidation after a big run.

One fund that purportedly combines software and exposure to the AI frenzy is the Invesco AI and Next Gen Software ETF (NYSEARCA:IGPT), which as the name implies, should give investors exposure to two key investing themes: AI and next gen software. While one could argue the fund does do this, I believe this fund is actually another mega-cap tech fund by another name. In this article, we’ll take a look at IGPT, and why I think there are better options for more direct software and/or AI exposure.

What is IGPT?

The fund describes itself as a way to invest in stocks with significant exposure to technologies or products that contribute to future software development through direct revenue. It tracks the STOXX World AC NexGen Software Development Index. The fund gets rebalanced once a quarter so the holdings below represent a recently-rebalanced look at the index.

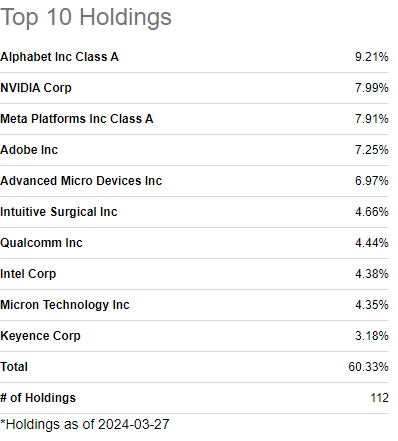

Seeking Alpha

Now, when I read this holdings list, I simply see another fund that’s extremely heavily weighted in mega-cap tech. The top three holdings are three of the biggest market caps in the entire world, followed by two more than are well into the hundreds of billions. When I think of “next gen”, I’m thinking of what’s next, not what’s already here and dominating respective markets. With a top five like what we see above, it’s just ~40% of the fund in mega-cap tech. Is AI and software part of the respective businesses represented here? Yes. Is that the focus? I would argue absolutely not.

Let me be clear that these are outstanding companies and they sport enormous market caps because they are leaders in their respective fields. But a next generation fund should, in my view, be focused on smaller companies with emerging products for the future, not those that are already “here” and performing.

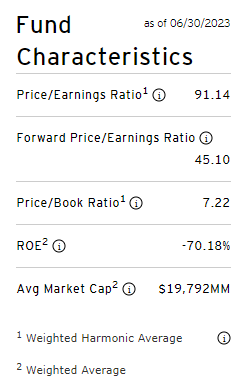

Fund website

The fund’s average forward P/E ratio right now is 45, which you’d probably expect given the kinds of stocks in the top 10. This is not a value fund, and never will be; you’re paying premium multiples for the right to access what should be very strong growth rates in the future. I don’t fundamentally have a problem with that, but it means you’re taking on valuation and execution risk if you decide to take a position. So long as growth materializes, 45 times earnings is probably fine. But if there’s a derailer of some type, downside can be swift and brutal.

We’ll move on to the technical picture in just a second, but for me, the composition of this fund is disappointing based upon its stated goal. I don’t see this fund as focused on next gen AI or software; the top holdings are full of advertising businesses and chip makers. This is why it’s important to know what you own when it comes to ETFs, and not to rely upon the name or description of the fund alone. You may disagree, and that’s fine.

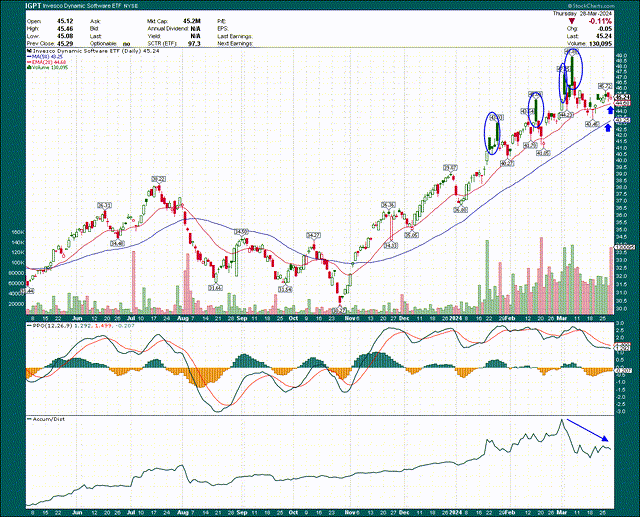

Rallies are being sold

When I look at the daily chart for IGPT, I see a massive uptrend, but one that appears it may be losing steam. I’ve circled four times this year that we’ve seen really sizable gap ups at the open that were sold all day. Dark green candles mean the security finished the day higher than the prior day, but lower than where it opened. We want hollow green candles to show intraday buying, but there’s very little of that here.

StockCharts

To be clear, IGPT is in a strong uptrend so long as it’s above the major moving averages. It remains there today, but we can see it’s been almost a month since it set a new high and momentum is waning. The PPO is drifting lower and hasn’t set a new high since it peaked in November of last year. That means bullish momentum is failing to move higher despite price moving higher. The accumulation/distribution line is actually in a three-week downtrend, which simply means that on balance, intraday volume has been bearish over that period.

Could these just be signals that IGPT is consolidating before another run higher? Definitely. However, given the weight of the evidence, I’m cautious and not convinced that the next move will be up. Technical analysis is about placing odds in your favor; it is not a guarantee. Right now, I don’t like the odds of the next move being bullish.

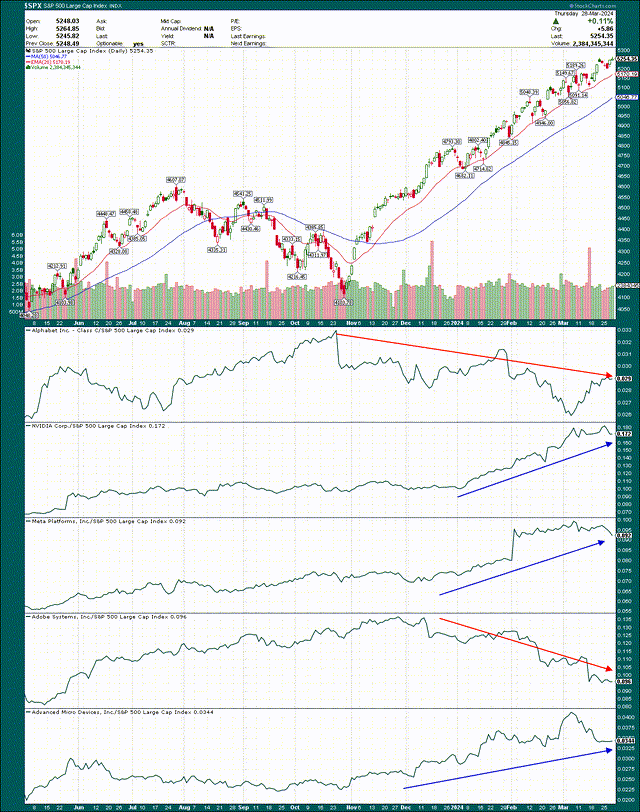

Given about two-fifths of the fund is in five stocks, let’s take a look at those companies’ outlooks to get an idea of what we are dealing with. Below we have a chart of the S&P 500, and in the bottom panels, the relative performance of the five largest components of IGPT to the S&P 500. When the component is outperforming the S&P 500, the line goes up, and vice versa.

StockCharts

Alphabet has been weak against the S&P since October low last year, and given it’s the largest component of IGPT, it’s been a drag on returns. We see roughly the same thing for Adobe, as its relative performance just continues to move lower. The other three have been very strong performers, but even so, they’ve all recently given up some of that relative performance.

I’ll say again that I have no problem with exposure to these five companies; they’re all leaders in their fields and will continue to make a lot of money for a long time to come. I just don’t see this as a next gen, AI, or even software-focused fund with a composition like this.

Other considerations

IGPT isn’t particularly liquid given its somewhat low volume, as the average bid/ask spread is 39 basis points. That’s an enormously high number and can eat into returns if you’re trading rather than buy-and-hold. The expense ratio is okay at 60 basis points given it’s an actively managed fund, so I’m neutral on that. It’s fine.

Annualized volatility is actually only about 1.5X that of the S&P 500, which is lower than you may expect given the name of this fund. However, that relatively low volatility is a function of it basically being a mega-cap tech fund (my opinion, of course).

Wrapping up

I’ll say again that IGPT is a good way to get exposure to mega-cap tech stocks, but in my view, is not a direct way to benefit from next gen AI or software developments. To me, it’s just another large cap tech fund by another name.

Fund website

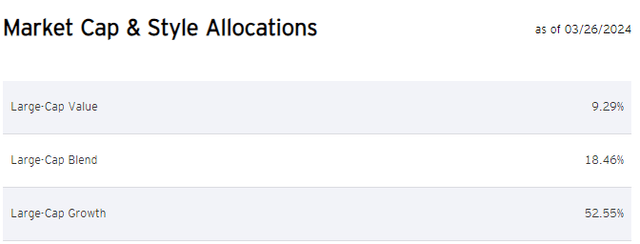

We can see in this graphic from the fund’s website that large caps are 80% of the fund, so you can make your own determination if this is representing the next generation or not.

I’m taking a pass on IGPT for this reason, but also because the technical picture is neutral at the moment. I see a strong uptrend that is in danger of fading further, so I prefer funds that are just starting or have a strong possibility of building upon current up moves. I’m starting IGPT with a hold for these reasons.

Read the full article here