Introduction

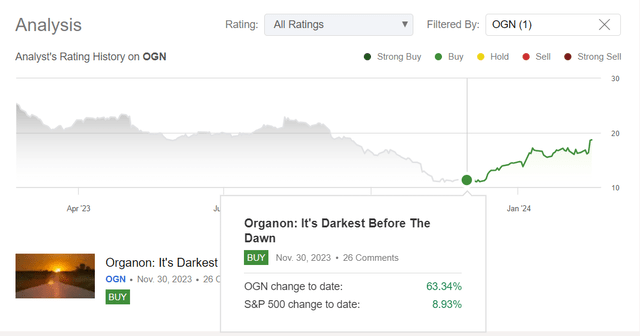

A quarter has passed since I initiated a “Buy” rating on Organon & Co. (NYSE:OGN). In this time the stock has gained around 63% – that’s 7 times more than the return of the S&P 500 Index (SPX) (SPY) in the same period:

Seeking Alpha, the author’s coverage of OGN

My prior optimistic outlook stemmed from the expectation of improved conditions for the company’s future growth trajectory and a robust drug pipeline, which I believed would counterbalance any valuation discount resulting from OGN’s relatively high debt burden. Armed with the latest quarterly report, alongside updated industry insights and management guidance, I decided to give OGN a fresh look today.

Recent Financials And Corporate Developments

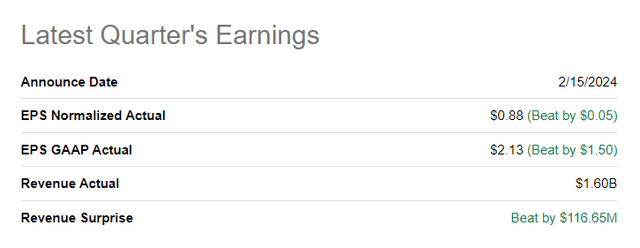

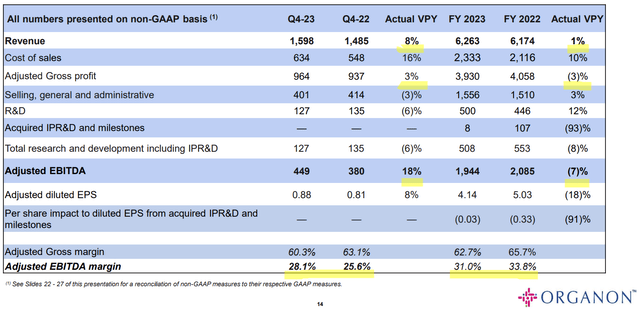

In Q4 FY2023, Organon reported strong financial results with an 8% growth in revenue both nominally and at constant currency, surpassing earlier guidance. Revenue for FY2023 was $6.3 billion, exceeding the high end of guidance provided previously. Adjusted EBITDA for the full year reached $1.9 billion, and adjusted diluted EPS amounted to $4.14. As a result, both top-line and bottom-line consensus estimates for Q4 have been beaten by healthy margins:

Seeking Alpha, author’s notes

Organon’s management remains committed to generating $1 billion in free cash flow in 2024, instilling confidence in the company’s financial stability.

We’re optimistic that we can deliver on a third consecutive year of constant currency revenue growth that’s also accompanied by some bottom line margin improvement and free cash flow of approximately $1 billion before one-time items.

Source: OGN’s Q4 FY2023 earnings call

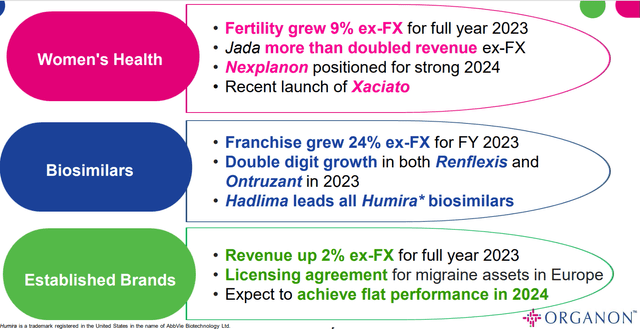

In the last quarter of 2023, Organon recorded positive changes in all of its business areas.

The women’s health franchise grew 3% for the full year, with notable contributions from fertility products and Nexplanon, which continues to show resilience and market leadership.

Additionally, the biosimilars division marked a second consecutive year of double-digit growth, driven by products like Renflexis and Hadlima, positioning Organon for substantial market penetration and potential blockbuster status.

Despite established brand segment challenges, Organon’s proactive measures to sustain growth through portfolio optimization and market expansion underscore a resilient business strategy. The company’s strong international performance, particularly in China, further bolsters optimism about its long-term prospects amidst evolving market dynamics.

OGN’s IR materials

I particularly like the fact that Organon’s margins are finally moving in the right direction: On an adjusted basis, the EBITDA margin improved by 250 basis points year-on-year in Q4, which is in stark contrast to the full-year dynamics. The same applies to business growth itself. Perhaps OGN has finally entered the turnaround phase.

OGN’s IR materials, author’s notes

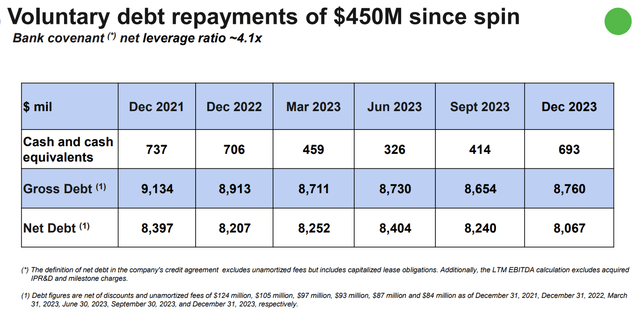

Moreover, the debt problem is gradually becoming less important, even if it still hangs over OGN like the sword of Damocles. In Q4 the company’s net debt fell by $173 million compared to the previous quarter, which in my opinion is a good sign.

OGN’s IR materials, author’s notes

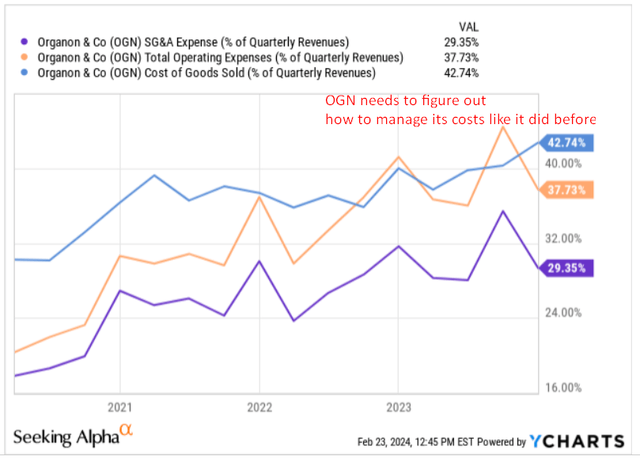

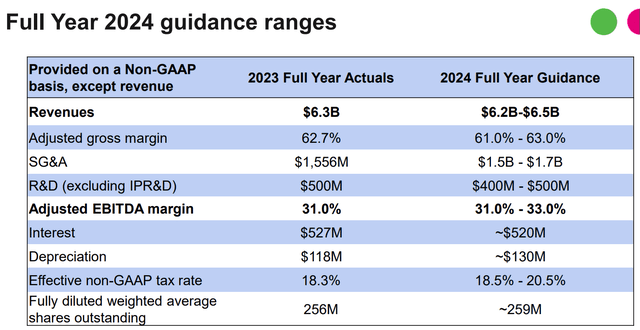

Looking ahead to 2024, Organon expects low single-digit revenue growth on a constant currency basis, with a revenue range of $6.2 billion to $6.5 billion. Adjusted EBITDA margin guidance is set at 31% to 33%. They want to achieve this kind of margin expansion thanks to revenue growth outpacing infrastructure expenses, cost containment measures, and potential incremental margin expansion from new product launches and manufacturing optimizations. In my opinion, however, the first 2 points are enough to achieve this goal. According to data from YCharts, the company had much better cost management a few years ago than it does today. If this problem is addressed, Organon’s financial performance should improve even faster than in the last reporting quarter.

YCharts, author’s notes

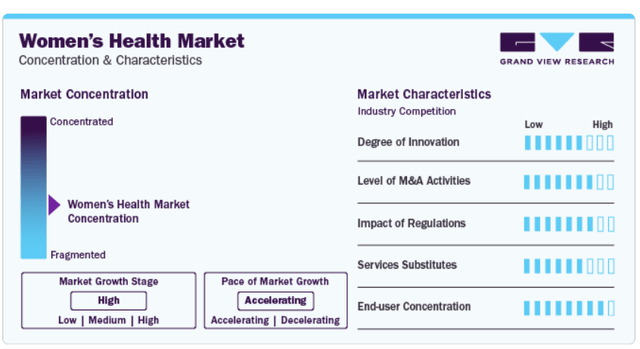

We cannot say with certainty whether management will honor its commitment to improve cost management. However, it seems to me that Organon’s business itself has significant long-term growth prospects. One reason for this is the state of the addressable (or better to say “serviceable”) market. According to the GVR’s recent research, the women’s health global market was estimated at $44.36 billion in 2023 and was expected to grow at a CAGR of 5.7% up to 2030. This is primarily due to the natural aging of the population, including the female population. And based on the same research paper, the concentration in this market is quite high, and the growth rate is only increasing.

Grand View Research

As the female population ages, the global growth rate of 5.7% seems relatively low compared to the potential increase we should expect in emerging markets, where increasing prosperity with an aging female population should, in my opinion, exceed this growth rate many times over. I am referring above all to China, where prosperity is growing rapidly. The population, including that of women, is also aging progressively. Organon intends to keep cultivating this market in the foreseeable future, according to management’s latest commentary.

In addition to China, other markets such as Brazil or Latin America as a whole also offer opportunities. In addition to the emerging markets, Europe has not yet been fully covered by Organon. One of OGN’s key selling products – Nexplanon – has achieved the number one market position in the large segment in the United States. The company mentioned efforts to launch Nexplanon in additional regions, including the European Union and Brazil, which are expected to contribute to sales growth. In addition, improvements in the go-to-market strategy, such as the full roll-out of pricing, are aimed at maximizing sales potential.

For FY2024, Organon anticipates strong free cash flow generation of approximately $1 billion before one-time items. CEO Kevin Ali’s commitment to reducing net debt further reinforces confidence in the company’s financial outlook.

OGN’s IR materials

Overall, I like the way the company is growing and the efforts management is making to finally turn this big boat around. But my decision on whether to rate OGN stock a ‘Buy’ rating again will depend on its valuation.

Organon’s Valuation Update

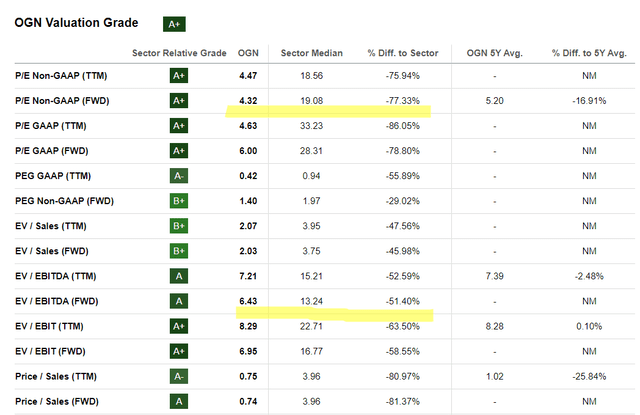

When I analyzed the stock in November 2023, it was trading at a forwarding P/E of 2.8x and an FWD EV/EBITDA of 5.8x, which were 85% and 55% lower than the sector’s median figures at the time, respectively. If you look at these multiples today, they have increased by 54% and 11% respectively. But each figure is still well below industry norms:

Seeking Alpha, OGN’s Valuation, author’s notes

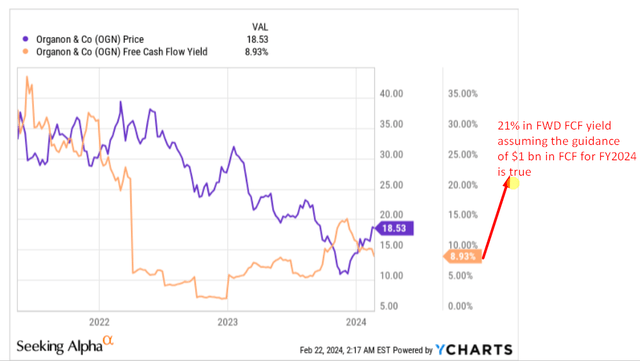

In addition, we have management’s assumptions on how much FCF the company intends to generate in FY 2024. If the target of $1 billion in FCF is achieved, this should theoretically lead to an FCF yield of around 21.1% at the current market capitalization. This still makes OGN one of the cheapest companies in the industry, in my opinion.

YCharts, author’s notes

I do not believe that the FCF yield of 21.1% will be sustainable – its seemingly inevitable decline should lead to further growth of the Organon stock in the medium term.

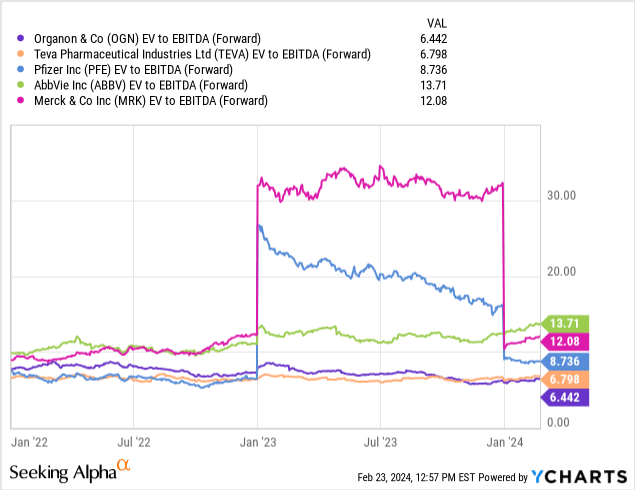

Apart from the fact that Organon appears relatively cheap in absolute terms, its key valuation multiples (such as FWD EV/EBITDA cited below as an example) are also attractive when compared to the corresponding indicators of peers such as Pfizer (PFE), AbbVie (ABBV) or Teva Pharmaceuticals (TEVA).

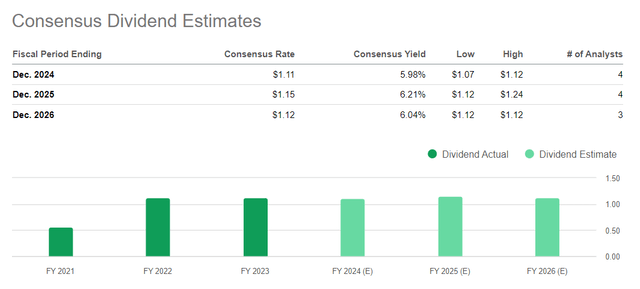

Organon also pays out generous dividends, which analysts expect to increase in FY2025:

Seeking Alpha, OGN’s dividend estimates

Organon’s projected dividend yield for the upcoming year is expected to be comparable to that of its peers.

The Bottom Line

Investing in OGN stock presents a mixed bag of opportunities and uncertainties that shareholders need to consider carefully. Although the company boasts profitability, a generous dividend, and attractive valuation metrics such as a low EV/EBITDA ratio or high next-year FCF yield, skepticism remains as to whether the spin-off from parent company Merck really adds value. Despite recent signs of recovery, particularly in women’s health and biosimilars, Organon’s long-term success depends on its ability to overcome challenges such as managing a high debt burden, executing successful businesses, and bringing new products to market. Although there is some optimism about the company’s potential, fueled by expectations of improved performance in regions such as China and Latin America, as well as management’s strategic direction, investing in OGN remains a speculative venture that requires careful monitoring of its progress and market conditions.

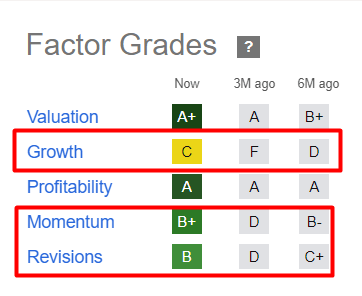

But in many ways, the risks I mention in the paragraph above are already priced into OGN’s valuation today – this is confirmed by the extremely low valuation metrics, which have not become less attractive even after the 60% increase in the stock price since the publication of my previous article. On the contrary, what has only improved are the business growth, momentum, and earnings revisions: Seeking Alpha’s Quant grades are a very handy tool to see this clearly.

Seeking Alpha, OGN, author’s notes

Due to the combination of fundamental factors developing positively around OGN, I have decided to maintain my previous ‘Buy’ rating.

Thanks for reading!

Read the full article here