I think there’s a clear argument to be made now to favor bonds over stocks, given we are entering a Fed cutting cycle. And within that? Actively managed bond funds. Why? Because as we transition to a different cycle, I suspect different parts of the bond market will diverge from each other meaningfully. Duration versus credit versus international factors should all have more importance. If I’m right, then the PIMCO Corporate and Income Opportunity Fund (NYSE:PTY) could be an interesting allocation here. This closed-end fund (CEF) run by PIMCO has a long history and solid performance over time, all things considered. PTY stands out due to its flexible mandate, which allows it to invest in a wide range of corporate debt securities and income-generating securities from non-corporate issuers.

While the fund doesn’t follow a specific index, people often compare its performance to broad fixed-income benchmarks. However, it’s important to keep in mind that PTY’s unique approach regularly results in performance that can differ from these benchmarks, in both positive and negative ways.

A Look At The Holdings

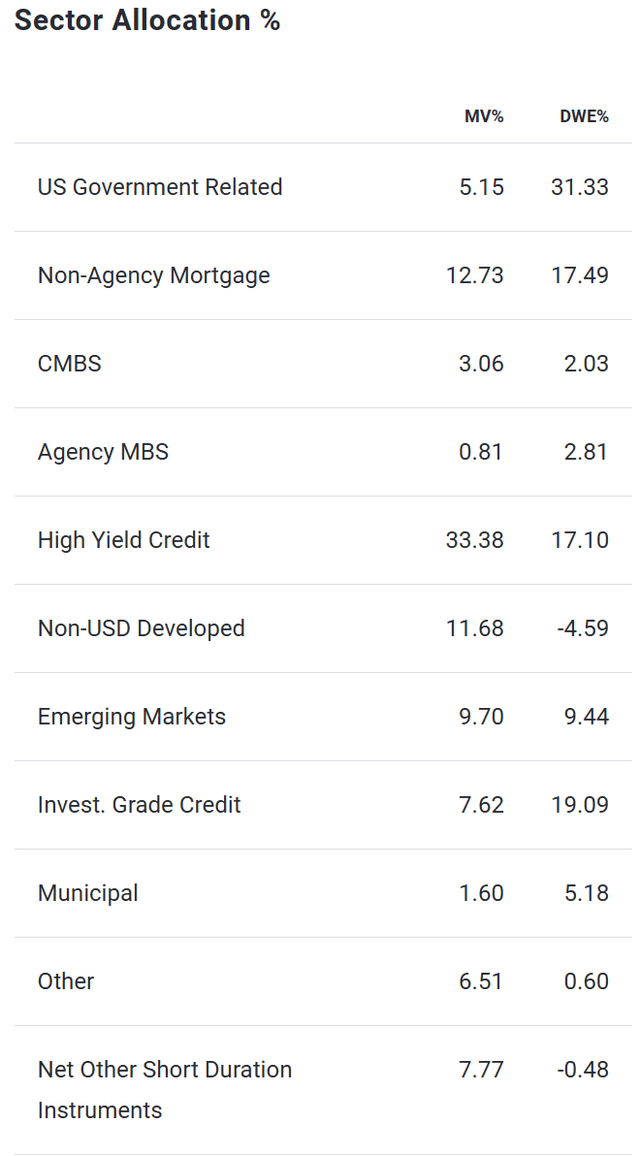

PTY’s portfolio consists of a well-chosen blend of corporate bonds, mortgage-backed securities, and other fixed-income instruments. While the fund’s holdings can shift due to market conditions and the manager’s perspective, let’s look at some of the main positions that have been the core of PTY’s approach.

pimco.com

High-Yield Corporate Bonds make up a big chunk of the portfolio, giving higher yields but with more credit risk. The fund managers use their know-how to pick bonds they think have the best balance of risk and reward. To even out the risk from high-yield bonds, PTY also holds some investment-grade corporate bonds, providing steadier income with less chance of default. It’s notable that PTY often puts some money into bonds from developing countries. These can pay more, but also come with extra risks tied to changing currency values and shaky political situations.

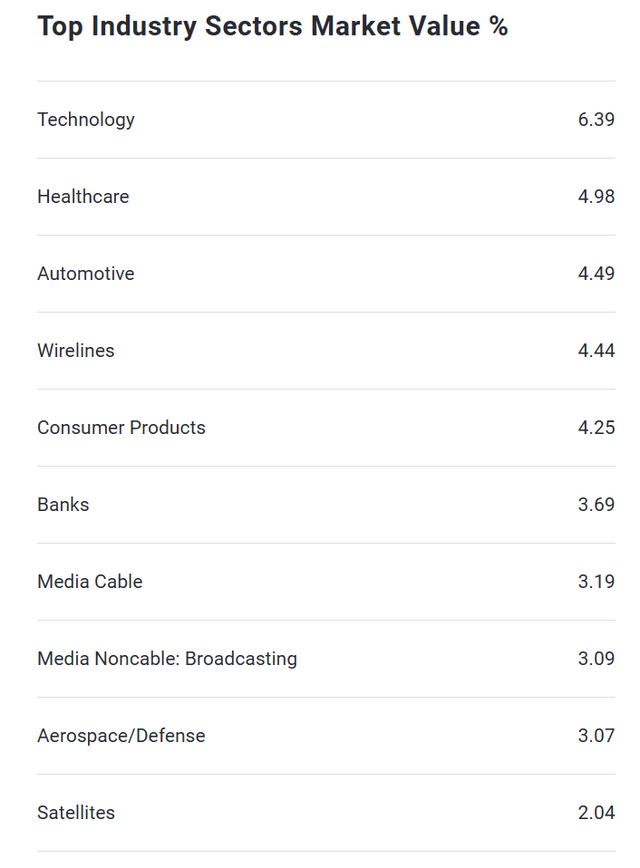

Sector and Global Allocation

PTY’s sector allocation proves its flexible mandate. The industry makeup is pretty even across the board in terms of corporate holdings. Good to see from a diversification standpoint.

pimco.com

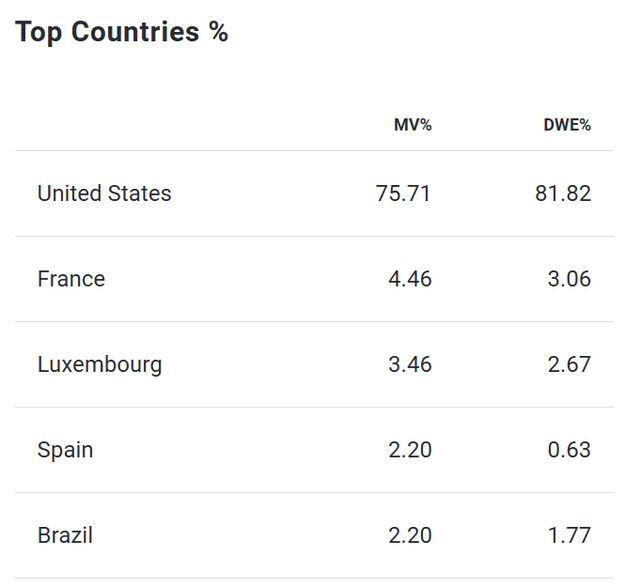

In terms of geography, while the fund focuses on U.S. securities, it typically invests in international markets too, including both developed and emerging economies. This worldwide strategy lets the fund take advantage of opportunities wherever they pop up, but it also puts investors at risk from currency fluctuations and political instability.

pimco.com

Peer Comparison

When we stack PTY up against other corporate bond CEFs, a few things jump out. The first? Leverage. PTY frequently uses more leverage than many similar funds. This can boost returns in good markets but also make things shakier and riskier when markets go down. This fund is also actively managed, which is a positive in the bond space in my view, but not a guarantee of outperformance by any means. And unlike ETFs, closed-end funds like PTY can trade at prices much higher or lower than their net asset value. Over time, PTY has often sold at a price above its NAV.

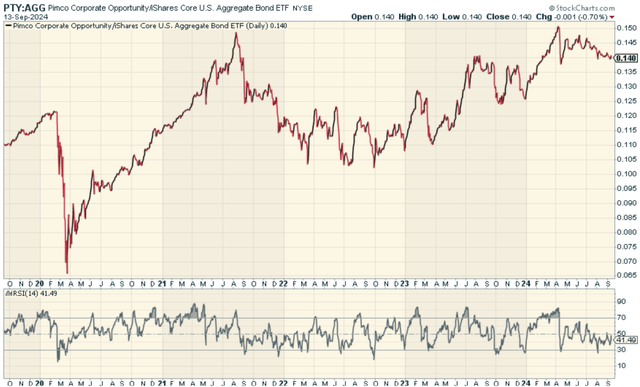

When we look at the price ratio of PTY to the iShares Core U.S. Aggregate Bond ETF (AGG), we find that it has indeed outperformed. I’m a little worried about the more recent weakness, but overall, good to see.

stockcharts.com

Pros and Cons

On the plus side, the fund gives investors a chance to access a wide range of fixed-income securities run by one of the most respected names in the field. The chance to earn high income attracts many when yields are low elsewhere. PIMCO’s global reach and research skills allow the fund to tap into opportunities that smaller managers might miss out on. And the distribution rate of 12.4% is proof.

But these upsides bring serious risks. Leverage can make losses worse when markets drop, and the fund might not always be able to keep up its high payout rate just from income. By focusing on corporate and high-yield bonds, the fund puts investors at risk of credit problems, which can get bad during economic slumps. Furthermore, the fund’s habit of trading above its NAV means people might be paying too much for what the assets are worth. This could lead to a price drop if that gap shrinks.

Conclusion

I like this fund. It has a long and strong history, the cycle seems favorable, and the active management alpha has paid off. If you want more fixed income bond fund exposure, this is a good fund to consider, though candidly it would be nicer if it were in an ETF format rather than it being a closed-end fund.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.

Read the full article here