The BlackRock Enhanced Capital and Income Fund Inc (NYSE:CII) is a closed-end fund that investors can employ in order to earn a very high level of income from the assets in their portfolios. The generation of income seems to be an increasingly popular theme nowadays as many retirees and other individuals who have significant assets are trying to use them as a way to earn the extra income needed to cope with today’s rising price environment. The BlackRock Enhanced Capital and Income Fund can certainly assist with this task as its 6.21% current yield is significantly higher than a money market fund or U.S. Treasuries. It’s also substantially higher than the yields offered by any of the major domestic common stock indices:

|

Index |

Current Yield |

|

Dow Jones Industrial Average Index (DJI) |

2.05% |

|

Dow Jones Transportation Average |

2.00% |

|

Dow Jones Utility Average Index |

3.08% |

|

iShares Russell 2000 ETF (IWM) |

1.51% |

|

NASDAQ-100 Index (QQQ) |

0.84% |

|

S&P 500 Index (SP500) |

1.34% |

(figures from Wall Street Journal)

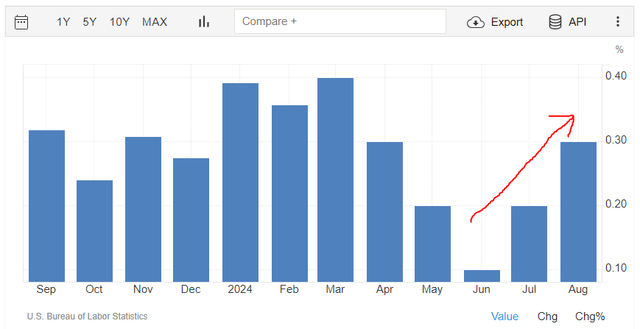

It’s appropriate to compare the BlackRock Enhanced Capital and Income Fund to the common equity indices because this fund invests primarily in common stocks. This should give it an advantage going forward because of the fact that equities do a much better job at protecting the purchasing power of an investor’s wealth than fixed-income securities. While the headlines generally praised the most recent 2.5% headline inflation number, a closer look at that report shows that inflation is far from beaten. In particular, the core inflation rate has accelerated since June:

U.S. Core CPI MoM Change (Trading Economics)

The core consumer price index increased by 0.3% in August, compared to 0.2% in July and 0.1% in June. That’s a sign that inflation could easily begin to accelerate if the Federal Reserve cuts later this month. In the pre-market session, futures suggest that a 50-basis point cut is increasingly likely, and that could very easily result in a rapid increase in acceleration. Investors would be wise to take action to protect themselves against this possibility by including things in their portfolio that will protect them against inflation. Common equities and common equity funds such as the BlackRock Enhanced Capital and Income Fund are one way to do that.

Thus, the fund does appear to have a lot to offer an income-focused investor. However, it’s important to note that this fund has a lower yield than some other funds that employ a similar strategy. We can see this quite clearly here:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

BlackRock Enhanced Capital and Income Fund Inc |

Equity-Covered-Call Funds |

6.21% |

|

Virtus Divid, Interest & Prem (NFJ) |

Equity-Covered-Call Funds |

9.35% |

|

Eaton Vance Enhanced Equity Income Fund II (EOS) |

Equity-Covered-Call Funds |

8.52% |

|

First Trust Enhanced Equity Income Fund (FFA) |

Equity-Covered-Call Funds |

7.00% |

|

Madison Covered Call and Equity Strategy Fund (MCN) |

Equity-Covered-Call Funds |

9.89% |

|

Voya Global Advantage and Premium Opportunity Fund (IGA) |

Equity-Covered-Call Funds |

10.92% |

As we can immediately see, the BlackRock Enhanced Capital and Income Fund has a yield that’s substantially below that of most of its peers. This probably suggests that the market expects that the fund’s current distribution is sustainable, but it also means that investors are leaving a lot of potential income on the table by choosing this fund over its peers. This is something that most income-focused investors will not want to do. However, the fact that this fund’s yield is substantially lower than its peers might mean that it has the potential to increase it. We will want to take a close look at the fund’s finances in order to determine whether or not this might be the case.

As regular readers can likely remember, we previously discussed the BlackRock Enhanced Capital and Income Fund in late August 2023. At the time, I suggested that the fund’s high exposure to the technology sector could prove to be a problem heading into the 2023 Jackson Hole Conference. That prediction proved to be correct, and the fund’s share price declined 9.72% from the date that article was published through Oct. 27, 2023, when the market bottomed out. That was worse than the 7.18% decline that the S&P 500 Index delivered over the same period. The fund’s share price would not turn positive again until mid-December 2023, and ultimately, it still closed out the year basically flat. The fund continues to substantially underperform the market today.

Here we see the fund’s share price performance from the date that my previous article was published until today:

Seeking Alpha

As we can clearly see, the fund underperformed the S&P 500 Index by a substantial margin. This is despite the fact that most of the giant technology companies that constitute some of the largest positions in this fund have outperformed the rest of the index over the same period. I pointed this out in a recent article. The fact that the fund has significant positions in some best-performing assets in the market should cause it to perform better than what we see here, and investors may wish to ask questions about why it is not. We will try to answer those questions today.

Fortunately, investors in the BlackRock Enhanced Capital and Income Fund have done somewhat better than the above chart suggests. As I explained in a recent article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

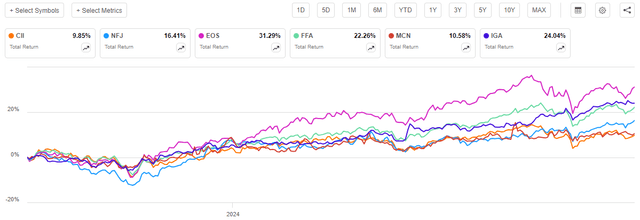

As a result of the fund’s distributions, investors will always do better than what the share price performance suggests. When we take the fund’s distributions into account, we get this alternative performance chart for the period:

Seeking Alpha

Unfortunately, we still see that the BlackRock Enhanced Capital and Income Fund underperformed the broader S&P 500 Index. In fact, it underperformed by quite a lot and almost certainly disappointed its investors. The fund was also the worst-performing one out of all the other funds in its peer group over the period:

Seeking Alpha

In short, it seems almost certain that most investors in this fund have been quite disappointed by this fund. It not only provides a lower level of income than its peers, but it also delivered a much lower total return over the past year. That’s not a trade-off that any investor would be willing to accept.

Fortunately, past performance is no guarantee of future results. A fund might underperform during one period and then outperform during the next one. As such, we should take a look at the fund’s positioning and financial condition today in order to make an educated prediction of where it could be heading. The remainder of this article will focus on this task.

About The Fund

The fund’s Website curiously does not provide an objective for the fund. It also does not provide any real insight into the fund’s strategy. Rather, all that the website states is this:

The Trust seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust also seeks to achieve its investment objective by employing a strategy of writing (selling) call and put options.

This is a much less insightful strategy description than BlackRock usually includes on its funds’ respective websites. When I first saw it, I suspected that there was a bug with the back-end database that prevented the full description from coming up. Thus, it’s possible that a better description will show up on the fund’s website and I hope it does because investors deserve proper descriptions of a fund’s strategy on their websites.

The fund’s annual report includes a slightly better description of this fund’s strategy. Here’s what this document states:

BlackRock Enhanced Capital and Income Fund, Inc.’s investment objective is to provide current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust also seeks to achieve its investment objective by employing a strategy of writing (selling) call and put options.

This is probably the description that should have been on the web page, although it still is not as insightful as the strategy descriptions provided by some peer funds. In particular, we want to know things such as how the fund is selecting the stocks that it includes in its portfolio as well as the specific characteristics of the call and put options being utilized. There are a lot of option strategies that closed-end funds use to generate income, after all.

The fund’s annual report also helpfully includes this strategy description which applies to the BlackRock Enhanced Capital and Income Fund as well as a few other funds in BlackRock’s fund family:

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue these goals primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options in an effort to generate current gains from option premiums and to enhance each Trust’s risk-adjusted return. Each Trust’s objectives cannot be achieved in all market conditions.

Each Trust primarily writes single stock covered call options and may also from time to time write single stock put options. When writing (selling) a covered call option, a Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price within an agreed-upon time period. The Trust receives cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trust. During the option term, the counterparty may elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust is obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received increased gains or reduced losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trust realizes gains equal to the premiums received. Alternatively, an option may be closed out by an offsetting purchase or sale of an option prior to expiration. The Trust realizes a capital gain from a closing purchase or sale transaction if the premium paid is less than the premium received from writing the option. The Trust realizes a capital loss from a closing purchase or sale transaction if the premium received is less than the premium paid to purchase the option.

This is a very good description of how a covered call strategy works, and it basically confirms that the BlackRock Enhanced Capital and Income Fund is running one. This is a safer strategy than the one employed by the Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV), which I discussed earlier this week. Unlike the Eaton Vance fund, the BlackRock Enhanced Capital and Income Fund will actually own the asset against which it is writing call options. This greatly reduces the fund’s risks because it does not have to worry about the underlying asset potentially appreciating rapidly during the option term and potentially forcing it to have to pay a very large amount of money to purchase the asset upon the option being exercised. Rather, the worst thing that can happen with the strategy that’s employed by this fund is that it has to sell an asset that it already owns at less than its market value at the time of exercise. This strategy, therefore, has the effect of limiting the potential gains that a fund can get from any particular asset. In exchange, the strategy does not have the potential for outsized losses.

The fact that a covered call strategy caps the potential upside that we can get from a common stock does result in the strategy reducing the inflation protection that we can obtain from equity securities. In exchange, the strategy provides investors with a reasonably attractive level of income. The managers of the BlackRock Enhanced Capital and Income Fund appear to be striking a balance between income and capital appreciation potential as only 52.56% of the fund’s stock holdings have options written against them. This means that the fund gets full benefit from any capital appreciation that occurs with the remaining 47.44%. That admittedly seems like a lot of potential capital appreciation to be giving up, so let us see how the fund’s peers compare:

|

Fund Name |

% Overwritten |

|

BlackRock Enhanced Capital and Income Fund |

52.56% |

|

Virtus Dividend, Interest & Premium Strategy Fund |

* |

|

Eaton Vance Enhanced Equity Income Fund II |

49% |

|

First Trust Enhanced Equity Income Fund |

63.92% |

|

Madison Covered Call and Equity Strategy Fund |

83.5% |

|

Voya Global Advantage & Premium Opportunity Fund |

49.42% |

* The Virtus Dividend, Interest & Premium Strategy Fund does not provide a figure for the percentage of its portfolio covered by call options. A look at its holdings report suggests that the figure is lower than for the other funds listed, but an exact number is not provided.

We immediately note that many of the other peer funds on this list have overwritten levels that are very similar to that of the BlackRock Enhanced Capital and Income Fund. This suggests that investors will have to sacrifice about the same amount of potential upside if they choose to go with another fund instead of this one. That does not, of course, mean that the net asset value performance of all of these funds will be the same as that depends on the actual equity securities that the fund holds, the characteristics of the options that it is writing, and various other factors.

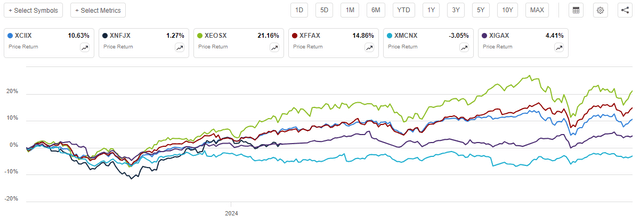

In fact, we can see here that the net asset value performance of the BlackRock Enhanced Capital and Income Fund has been very good relative to its peers since our previous discussion:

Seeking Alpha

We can see that the fund’s net asset value is up 10.63% since our previous discussion. The only two funds that performed better than this one are the Eaton Vance Enhanced Equity Income Fund II and the First Trust Enhanced Equity Income Fund. This is despite the fact that the fund’s share price performance over the period was very disappointing, as was its total return relative to its peers.

The fact that the fund’s net asset value has increased by 10.63% over the period strongly points to the fund distributing less than its portfolio actually generated over the period. However, this fund did not increase its distribution as a few of the other funds did. The Eaton Vance Enhanced Equity Income Fund II increased its distribution in April 2024 and the First Trust Enhanced Equity Income Fund increased its distribution in June 2024. As I mentioned in previous articles, closed-end funds sometimes trade based on their distribution yield, and so if this fund had increased its distribution, then it might have delivered a better performance in the market. The low distribution thus looks to have been a performance drag.

Here, we see a potential opportunity then. If this fund continues to deliver reasonably strong net asset value performance, it will probably end up increasing its distribution at some point. That should serve as a catalyst to push the share price higher as well as increase the income that the fund provides to its investors. It’s uncertain when and if the fund will actually take this step, but anyone who purchases it today will be positioned to benefit from such an event.

Portfolio Changes

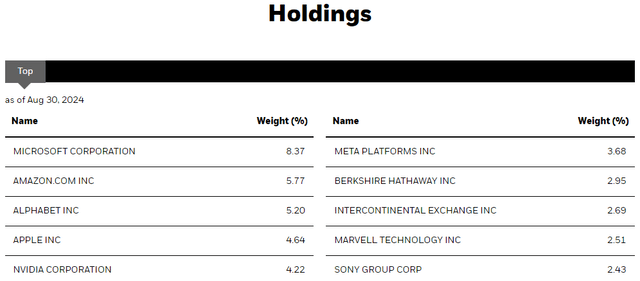

As we saw the last time that we discussed the BlackRock Enhanced Capital and Income Fund, the fund’s portfolio was very heavily weighted toward giant US technology companies. This continues to be the case today, which we can see from looking at the largest positions in the fund. Here they are:

BlackRock

We can see here that the six largest positions in the fund’s portfolio are the so-called “Magnificent 7” stocks. The only member of that grouping that’s not included in the fund’s largest positions is Tesla, Inc. (TSLA), which is not surprising considering the poor performance that Tesla has delivered year-to-date (a 14.08% decline).

The BlackRock Enhanced Capital and Income Fund actually increased its exposure to the mega-cap technology companies since the last time that we discussed it. One of the most significant changes that we have seen to the above list since the time of our previous discussion is that Comcast Corporation (CMCSA) was removed and replaced with NVIDIA Corporation (NVDA). Other significant changes are the removal of Applied Materials, Inc. (AMAT), UnitedHealth Group Incorporated (UNH), and Corteva, Inc. (CTVA) from the fund’s largest holdings list. The new additions that replaced them are Intercontinental Exchange, Inc. (ICE), Marvell Technology, Inc. (MRVL), and Sony Group Corporation (SONY).

The real risk to investors here comes from the substantial exposure to only a handful of technology companies. These same technology companies are also heavily weighted in the S&P 500 Index and most equity funds that include domestic stocks. Thus, most American investors are significantly exposed to their stocks and an outsized proportion of their wealth depends on the performance of these six companies. As such, it would be wise to take a look at the other assets in your portfolio and ensure that proper diversification is present before purchasing shares in this fund.

Distribution Analysis

The primary objective of the BlackRock Enhanced Capital and Income Fund is to provide its shareholders with a high level of total return through a combination of current income and capital appreciation. Most closed-end funds primarily deliver their investment returns by making direct payments to their shareholders and this one is no exception. To that end, the fund pays a monthly distribution of $0.0995 per share ($1.194 per share annually), which gives it a 6.21% yield at the current share price. As we saw in the introduction, this is quite a bit lower than most of its peers.

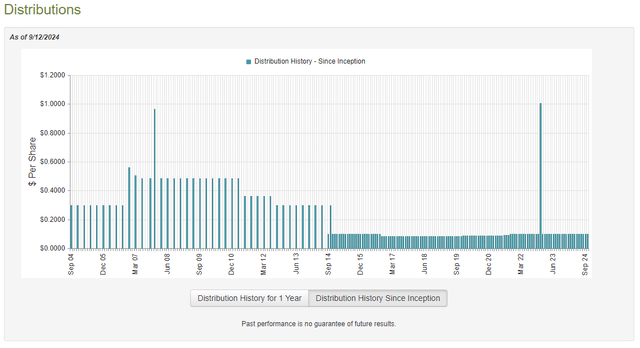

The BlackRock Enhanced Capital and Income Fund has not been especially reliable with respect to its distributions over the years. We can see this here:

CEF Connect

As I stated in the previous article:

As we can see, the fund has generally been increasing its distribution since the middle of the last decade, although it has not been perfect in this respect. The fact that it did not have to cut in response to the tightening monetary environment in 2022 speaks well for the quality of its portfolio and strategy, since some of Eaton Vance’s option-income funds did have to cut during the same year. As is always the case though, we want to ensure that the fund can actually afford the distributions that it pays out. After all, we do not want to be the victims of a distribution cut, since that would reduce our incomes and almost certainly cause the fund’s share price to decline.

The fund’s distribution has not changed since our last discussion, so there’s nothing new to report there. However, my previous article was published over a year ago, so the fund has released some updated financial information. Let us take a look at it now in order to see how well this fund is sustaining its current distribution.

As of the time of writing, the most recent financial report that’s available for the BlackRock Enhanced Capital and Income Fund is the semi-annual report for the six-month period that ended on June 30, 2024. We will use this report for our financial update on this fund today.

For the six-month period that ended on June 30, 2024, the BlackRock Enhanced Capital and Income Fund received $5,544,611 in dividends from the assets in its portfolio. The fund had no interest income for the period. It had to pay some money in foreign withholding taxes though, so we subtract that amount from the total in order to arrive at a total investment income of $5,403,217 for the period. The fund paid its expenses out of this amount, which left it with $1,312,980 for the period. That was not sufficient to cover the $26,355,711 that the fund paid out in distributions during the period.

Fortunately, the fund was able to make up the difference through capital gains. For the six-month period that ended on June 30, 2024, the fund reported net realized gains of $21,274,980 along with $68,781,404 in net unrealized gains. Overall, the fund’s net assets increased by $65,013,653 after accounting for all inflows and outflows during the period.

As we expected, this fund easily covered its distributions with a lot of money left over. It’s almost curious why it has not increased its distribution yet, although perhaps it’s waiting until after the end of the fiscal year to do so. If its net asset value continues to grow, then it seems almost certain that we will see a distribution increase.

With that said, some readers might note that the fund failed to cover its distribution fully solely with net investment income and net realized gains. It had to rely on its unrealized capital gains to afford it, and there’s no guarantee that will be sustainable. While this is true, it seems unlikely that it will be a problem. The fund did come pretty close to covering its distributions solely out of realized gains and net investment income, so some market weakness will probably not cause its losses to get so big as to erase all the gains that it has had over the past eighteen months. The fund had $99,783,709 in asset appreciation in excess of its distributions over the full-year 2023 period and $65,013,653 added to it during the first half of this year. If the market really starts to decline rapidly, it will probably be able to realize some of those gains before it loses all of them. In addition, the market has been pretty strong since the end of June despite some fears of a recession so it seems unlikely that a severe crash will occur in the near future.

Thus, the distribution appears very safe at its current level and the fund appears to be financially able to increase it. That increase may come around the end of this year.

Valuation

Shares of the BlackRock Enhanced Capital and Income Fund are currently trading at an 8.14% discount to net asset value. This is reasonably in line with the 8.84% discount that the shares have averaged over the past month when we consider that the share price is up 1% since the last net asset value calculation. This could be a reasonable entry point for anyone who wishes to add this fund to their portfolio.

Conclusion

In conclusion, the BlackRock Enhanced Capital and Income Fund is a very tech-heavy covered call fund that has delivered a disappointing performance in the market over the past year. However, the fund’s portfolio has done much better than the share price would suggest, and this could mean that a distribution increase will occur in the near future. That could serve as a potential catalyst for share price appreciation, or it will at least increase the yield that investors receive on their money to one more in line with its peers. In any case, this fund does appear to be doing better than its recent share price performance would suggest.

Read the full article here