My Thesis Update

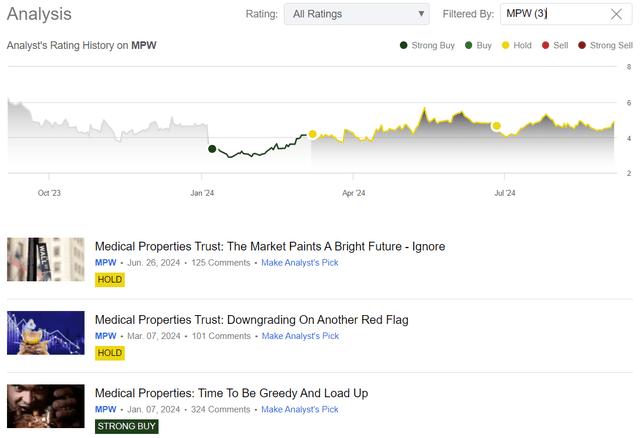

I initiated coverage on Medical Properties Trust, Inc. (NYSE:MPW) stock on January 20, 2024, with a “Strong Buy” rating, saying that investors need to be greedy while others were fearful at the time. It was a speculative call in its nature, and the main argument I wrote was that MPW’s undervaluation combined with its high short interest and solid support from the 2009 crisis made the stock attractive to medium-term dip buyers. The stock was up 23.3% after 3 months, and then the news hit the market that seemed to me a sufficient red flag to downgrade MPW to “Hold” – the lack of an auditor’s consent filing. Simultaneously, other news emerged, primarily concerning the bankruptcy of Steward. Then, another piece of negative news emerged: the company announced a sharp reduction in dividends to common stock investors. But the stock price didn’t react negatively amid all that, as far as I can see it:

Seeking Alpha, Oakoff’s coverage of MPW

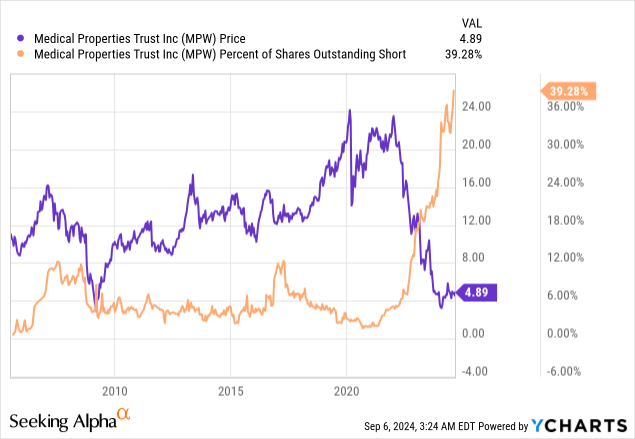

I believe that MPW stock’s price consolidation over the past several weeks, which has prevented it from falling below the established price channel, may indicate that even minor positive news could significantly boost the stock’s value. It seems to me that such a catalyst may be on the horizon. Additionally, the extremely high short interest, exceeding 39% of the total float as of today (YCharts data), could serve as a serious trigger for a substantial upward movement in Medical Properties Trust stock – hence my upgrade to “Buy” today.

My Reasoning

My previous article came out before the recent financial report from MPW, so I believe without taking a look at the fundamentals under the hood it’d be inappropriate to talk about “stock price consolidations” and stuff like that.

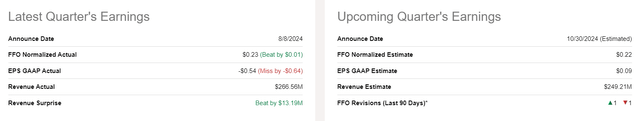

For Q2 2024, MPW reported a GAAP net loss of -$0.54/share and normalized FFO of $0.23/share, missing and beating the consensus estimates, respectively. The company’s top line amounted to $266.56 million, beating expectations by over 5% – the biggest positive surprise since Q2 2021.

Unlike in Q1 2024, when the company massively fell significantly short of market expectations on all fronts, this time everything went more or less smoothly and didn’t trigger a wave of downward consensus revisions for the next quarter:

Seeking Alpha, MPW

MPW’s management said during the earnings call that the firm managed to execute >$2.5 billion in transactions so far this year (by the end of Q2), involving roughly 50 hospital facilities in “5 major transactions at attractive valuations.” MPW also completed the sale of 5 hospitals to Prime for ~$350 million, consisting of “cash and an interest-bearing mortgage.” So they actually exceeded their initial liquidity target for FY2024, generating ~$2.5 billion in total liquidity, which allowed them to repay all debt scheduled to mature in 2024, according to the commentary.

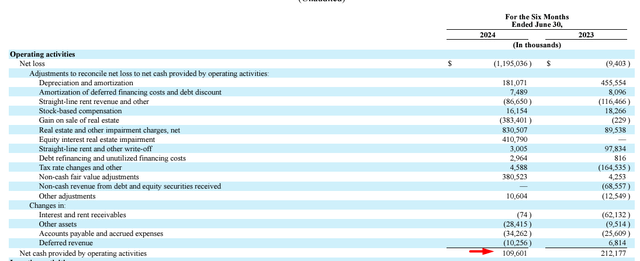

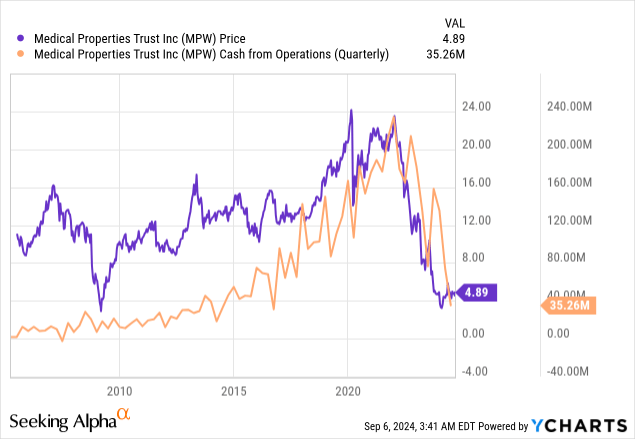

It is clear that impairment charges and changes in equity in the last two quarters were the main reasons for the massive net loss of almost $1.2 billion in the first half of the 2024 financial year, but even if you exclude these items, the cash flow statement still looks somewhat worrying, as the CFO’s volume has almost halved YoY, somewhat explaining the ugly price action:

MPW’s CF statement, notes added

The stock market seems well aware of the fact that MPW’s biggest tenant, Steward Healthcare, is undergoing a Chapter 11 restructuring process, and Medical Properties Trust is deeply involved in this process, particularly in Massachusetts, where they own ~50% of 8 properties through a joint venture. As Seeking Alpha recently reported, Steward Health Care reached an agreement with MPW to settle disputes over leasing claims: now MPW should take over Steward’s hospitals that are subject to its master lease and then cover all related OPEX, while the proceeds from the sale of these hospitals “will be used to make payments to lenders and creditors.” We know that MPW had previously written off a $360 million loan in Q1, which was secured. So since the agreement we’re talking about includes a potential recovery for general unsecured creditors, it could suggest that if the secured debt is fully paid, MPW might recover some of this amount. If it’s true, the benefit for MPW will be massive, and it’s all unexpected, from my understanding.

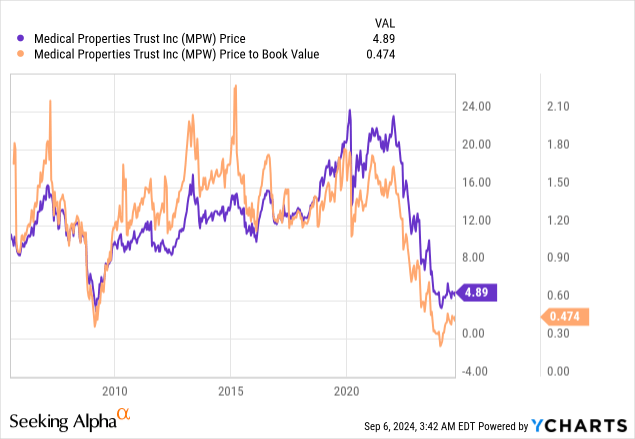

I don’t believe that the potential bullish catalyst is currently reflected in the stock price of MPW, as the price-to-book multiple in particular is now at 0.50x, which is roughly equivalent to the lows seen during the 2008-2009 crisis:

At the same time, the number of people short-selling the MPW stock is at a historical peak: Currently, the percentage of shares sold short exceeds 39% of the float, according to YCharts data.

In my opinion, all this gives rise to a rather interesting scenario. We are facing a bullish catalyst that few are talking about. In the meantime, the stock price has not reacted to the consistently negative data of the last quarter. In addition, bearish sentiment towards Medical Properties Trust is at an all-time high, judging by the short interest. With that in mind, I think the current extreme fear surrounding this stock could lead to massive short-covering if the expected catalyst I mentioned earlier or any other unexpected catalyst materializes.

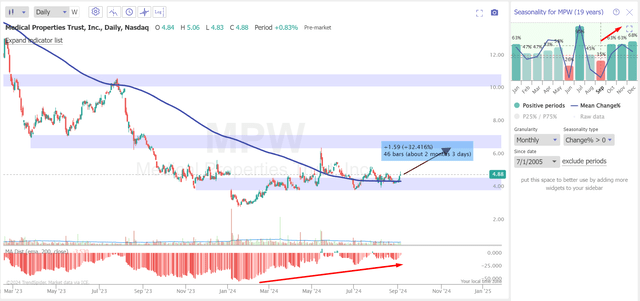

Now technically speaking, I see that September is usually a weak month to buy MPW, but the stock seems very promising overall, flirting with its 200-day moving average and trying to establish itself above it and reverse the long-term downtrend that has frustrated many bulls. In this context, I have positive expectations for the stock.

TrendSpider Software, Oakoff’s notes added

Yes, the company will still face major challenges from a fundamental perspective, such as debt repayments, refinancing, and further asset sales. However, I think the market has already heavily discounted the stock price and absorbed most of the existing risks. As there’s now a possibility that some write-downs made in the first quarter can be recovered and will be reflected in the financial statements in the second half of 2024, I believe this is a sufficient argument to raise my rating from “Hold” to “Buy”.

Risks To My Rating Upgrade

As I’m sure you’re aware, investing in Medical Properties Trust carries significant risks, particularly with regard to asset quality and the deteriorating debt and rental coverage ratios of the operators. The company’s dependence on the financial well-being of its operators makes it vulnerable to changes in market conditions that may affect rental income and the overall value of the assets.

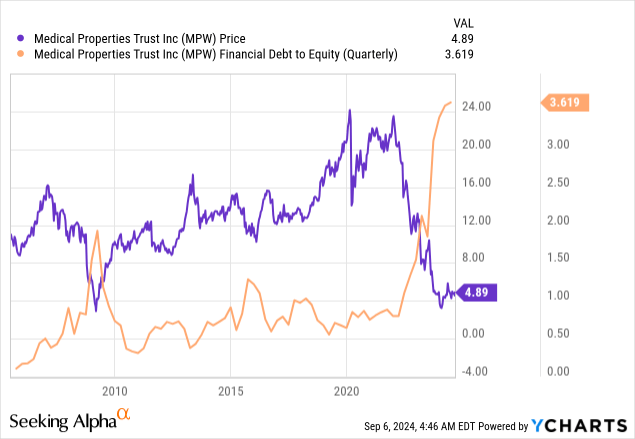

The risk of escalating debt is another cause for concern. If MPW maintains today’s high debt-to-equity ratio going forward, the company will become more susceptible to economic fluctuations.

Also, MPW’s profitability and cash flow concern me, as they could be affected by increased interest expenses, putting a strain on its financial position. The recent sharp decline in dividend payments also does not support my decision to upgrade today.

Your Takeaway

Despite the obvious risks surrounding the company, which have made it a ‘dirt cheap’ stock in market terms, I still believe that, based on a combination of factors, the worst is behind MPW. If we examine the company’s reactions – more specifically, the recent behavior of its stock price – we may conclude that the market is eagerly anticipating some positive change as the stock refuses to break down lower. Meanwhile, the number of short positions continues to rise, creating the potential for a short squeeze if a bullish catalyst emerges. I discussed one possible catalyst in today’s article, but there may be others – feel free to share your thoughts in the comments; I’d be interested to hear them.

Anyway, based on the factors discussed in today’s article, I conclude that MPW deserves an upgrade, at least for the medium-term outlook.

Good luck with your investments!

Read the full article here