Littelfuse (NASDAQ:LFUS) is currently richly valued, but because it is about to experience a substantial upcycle in FY25, I think this matters little to its near-term alpha potential. Based on my peer analysis and valuation assessment, the stock could increase by around 23% in 12 months. However, there are risks for the coming year, including geopolitical uncertainty, which could create supply chain vulnerability for the company, and new innovation challenges related to AI and edge computing compatibility.

Operational Analysis

Littelfuse specializes in designing and manufacturing electronic components; it is primarily focused on circuit protection products. The largest segment of its operations for revenue and operating profit is electronics, where it focuses on products that enhance electrification, energy efficiency, and digital connectivity. Its other two core segments are transportation (where it focuses on circuit protection, power control, and sensing technologies essential for vehicle safety and efficiency) and industrial (where it provides protection, control, and sensing products for various industrial applications).

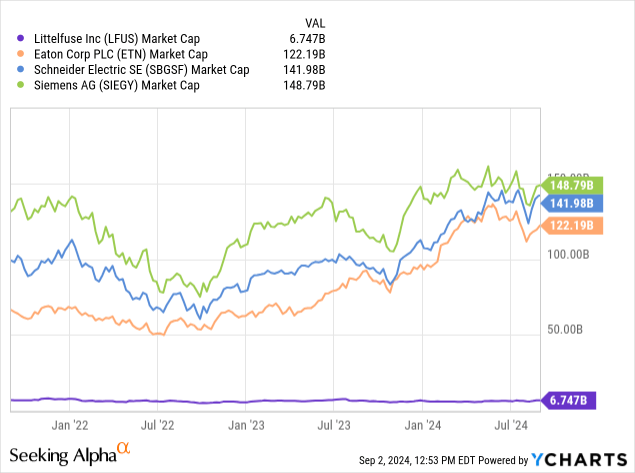

The company competes with a multitude of other, often much larger, firms. Three that particularly stand out are the Eaton Corporation (ETN), Schneider Electric (OTCPK:SBGSF), and Siemens (OTCPK:SIEGY). However, these are all much larger and perhaps provide a good picture of the players preventing outsized growth for Littelfuse if it isn’t effective in strong innovation, acquisitions and a unique market strategy.

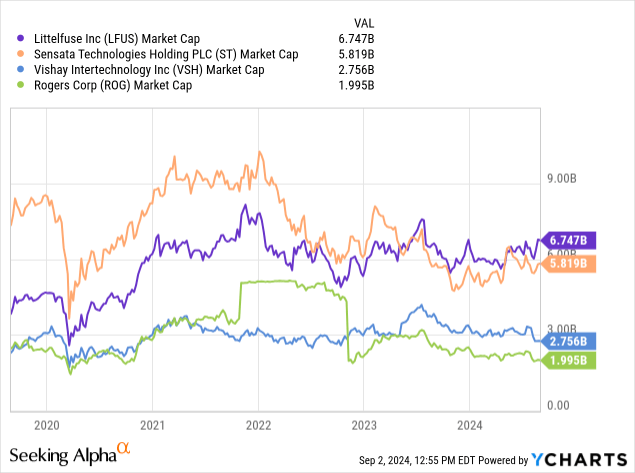

Instead, I believe Sensata Technologies Holding (ST), Vishay Intertechnology (VSH), and Rogers Corporation (ROG) offer a better peer analysis when it comes to financial and valuation metrics because they have a similar market cap to Littelfuse.

Sensata is a global industrial technology company that develops sensors and controls; Vishay is a manufacturer of discrete semiconductors and passive electronic components; Rogers Corporation is known for its high-performance engineered materials and components.

FY24 has not been a strong year for Littelfuse, as it has faced many customers reducing their inventories and lower demand in certain end markets. Its sales are subject to cyclical trends, and the company has been going through a downcycle in FY24. In Q2 2024 it reported a 9% decrease in net sales, reflecting this hardship. However, long-term secular trends in electrification and renewable energy are set to be accretive to the company in FY25. This arguably comes at a time when the macro environment in the United States, one of Littelfuse’s core markets, looks set to ease interest rates and hopefully lower inflation. That being said, there are no guarantees of this, and depending on the strategy with the U.S. federal budget, we could enter a recessionary period, which would negatively impact Littelfuse despite current optimism for the stock on Wall Street.

Littelfuse Wall Street EPS Estimates (Seeking Alpha)

However, Littelfuse is also well-diversified overseas, with significant revenue from China, another one of its core markets, as part of a total customer base from 20 countries across North America, Europe and Asia. This provides some security to future growth estimates due to geographic diversification.

In my opinion, we can be bullish on Littelfuse for its strong focus on innovation, as well as its strategic acquisitions that are allowing it to expand its market reach. One of its notable acquisitions is the TTape platform, which is an advanced overtemperature detection solution for electric vehicle (EV) Li-ion battery packs. This system detects localized cell overheating, preventing thermal runway incidents in EVs and energy storage systems. Furthermore, Littelfuse’s notable acquisitions include C&K Switches, a select product portfolio from Onsemi (ON), and TE Connectivity’s (TEL) circuit protection business.

Financial Analysis

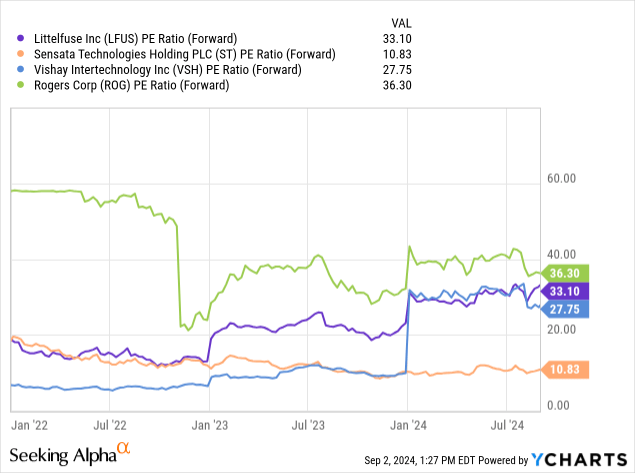

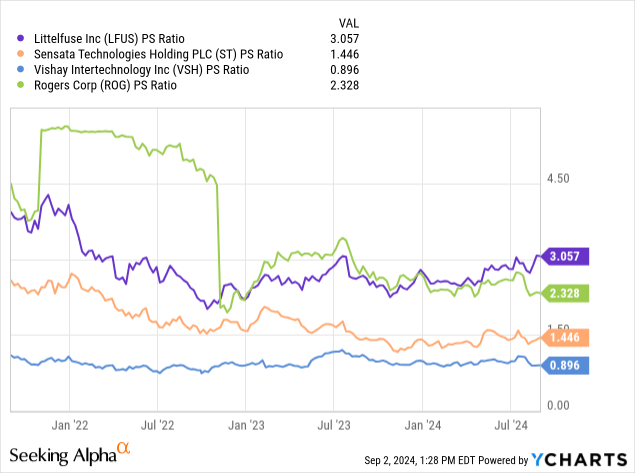

Littelfuse is not cheap, with a forward P/E non-GAAP ratio of 33.10, a 27.70% increase from its 5-year average, and a forward PS ratio of 3.05, a 3.54% increase from its 5-year average. It is also the most richly valued of its similar-sized peers in my selection on a PS-ratio basis, and the second most richly valued on a PE-ratio basis.

| Company | FY25 Revenue Growth Estimate | FY25 Normalized EPS Growth Estimate |

| Littelfuse | 8.31% | 35.95% |

| Sensata | 4.04% | 10.72% |

| Vishay | 9.67% | 92.56% |

| Rogers | 7.34% | 52.62% |

Based on the data in the above table, it is clear why Littelfuse is richly valued, but it is not clear why it is the most richly valued of the peer set. Vishay offers much better value and much higher future earnings estimates. Therefore, I personally would say that Littelfuse is overvalued right now, and I expect a contraction in its P/E ratio down toward 30, or potentially even lower. I believe that the market has already begun to price in Littelfuse’s growth for FY25 into the stock early.

Based on my analysis, if the Wall Street consensus EPS estimate of $11.18 is achieved by the company, the stock would be worth $335.40 in 12 months’ time if it has a contracted P/E ratio of 30, as I suggest. This indicates price growth of 23.22% in a year, indicating that Littelfuse stock is a Buy.

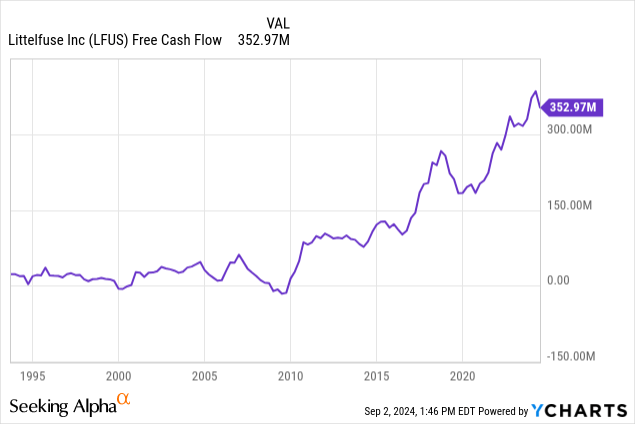

Littelfuse also has notably strong free cash flow growth, which helps to offset its weak liquidity situation at the moment, with a cash-to-debt ratio, including lease obligations, of just 0.61. Littelfuse also only uses moderate SBC ($24.5M TTM compared to $194.6M in net income), meaning only moderate share dilution, and most of its high cash from operations is the result of depreciation, amortization and change in inventories.

Risk Analysis

AI integration and edge computing are currently transforming the consumer electronics industry. Littelfuse is going to face increasingly advanced AI and edge computing demands in electronics, sensors, and industrial applications, and so it will likely need to make heavy investments in its technological proficiencies to ensure that it remains competitive. This is both an opportunity and a potential area of vulnerability as larger companies, namely those I listed initially in my operational analysis, Eaton, Shneider, and Siemens, are likely to be able to invest more heavily in this area to make highly compatible products. This could potentially create further market consolidation and weaken the position of smaller firms like Littelfuse, Sensata, Vishay, and Rogers. This is why I believe it will be increasingly important for Littelfuse to focus on niche markets that may have less focus from larger firms and also continue to acquire technologically advanced companies, portfolios, and divisions, which could help it to expand and remain relevant if it does not have the infrastructure to develop advanced AI and edge computing compatible products in-house.

Additionally, as there are currently greater global conflicts and a more fragmented global order, the chance of supply chain disruptions is increasing. We could see higher international tariffs, which could be particularly troubling for Littelfuse as it has 23% of its operating revenue from China, but it is headquartered in the United States. I believe there is a significant chance of upheaval between these two nations, and while I am hopeful of a peaceful resolution, I do see further international disputes as increasingly likely, unfortunately. Any further hot wars in FY25 could cause production delays, increased costs, and weakened demand in end markets for Littelfuse. However, the company currently has facilities in the United States, Mexico, China, the Philippines, and Lithuania, among other countries; therefore, it is well-diversified, allowing for strategic supply chain plans if geopolitical tensions do escalate, which is reassuring. It is also worth remembering that such geopolitical unrest would have wide-ranging and industry-diverse ramifications, so staying invested generally may be wise if the threat is not considered severe, which, at this time, I still consider to be the case.

Conclusion

I think there is a reason to be bullish on Littelfuse in FY25; while its valuation at this time is not ideal, its growth rates for next year more than make up for this. While potentially not the best investment of its similar-sized peers, with that position going to Vishay, in my opinion, Littelfuse is strong, well-diversified, and has a shrewd innovation and acquisition strategy. There are risks, particularly related to AI and edge computing compatibility, which is a capability that could be consolidated by larger firms. However, Littelfuse has a track record of strategic acquisitions, which, I believe, could allow it to remain competitive. I believe, based on a slight valuation contraction but strong FY25 EPS growth anticipated on consensus, the stock could appreciate by around 23% in 12 months.

Read the full article here