An emergency fund should be a priority for Americans to be prepared for unforeseen and urgent expenses. Experts recommend you should have several months of living expenses saved that can be used for emergency situations.

“We recommend having three to six months’ worth of expenses saved in an emergency savings fund but even as little as a few hundred dollars has been found to significantly increase financial stability,” Meagan Dow, senior strategist at Edward Jones, told FOX Business. “For example, if you can put away $50 per month, within a year you’d have $600, or more, with interest saved up for an emergency. While at the moment you may not feel a difference, putting that money aside month over month, it does make an impact in the long run.”

Life is unpredictable, and unexpected expenses may arise, like needing home or car repairs, Dow said.

“Or, your income can drop, such as if your hours get cut, or you lose your job,” she said.

MOST AMERICANS CANNOT AFFORD A $1K EMERGENCY EXPENSE

In addition, other emergency situations can also come about, like medical events or expenses.

“This can cause both an increase in unexpected expenses and a drop in income at the same time,” Dow noted.

Why is an emergency fund so important?

Dow explained that having a “rainy day” fund helps you avoid going into debt or dipping into your retirement savings when things don’t go as planned.

“It also gives you the ability to live your life more on your own terms,” she added. “It can give you the flexibility to make changes that you might not make if you weren’t financially comfortable, such as leaving a bad job or relationship. If you have the funds, you have more freedom to make a change.”

Why is it so vital at the beginning of the new year?

Dow said the best time to create an emergency fund is at the start of the new year.

COST OF LIVING HINDERS YOUNGER GENERATIONS FROM SAVING FOR RETIREMENT: FIDELITY

“Now is a good time to commit to better financial habits,” Dow explained.

In fact, according to a recent Edward Jones study, for those who were unable to maintain financial resolutions in 2023, one of the top factors hurting their efforts was unexpected life events (51%).

“Building your financial reserve now will allow you to not let 2024 catch you off guard,” Dow said.

As you begin your plans to build your emergency fund, use these expert strategies:

Split your paycheck

Most employers allow employees to deposit their paycheck in multiple places, Dow said.

CRAFTING RESILIENT FINANCIAL GOALS FOR LASTING SUCCESS IN 2024

“If this is an option for you, allocate part of your paycheck to go directly to a separate account that serves as your emergency fund,” Dow told FOX Business. “Creating an easy, frictionless, automated option to build your emergency savings fund can help ensure you stay on track and not ‘miss’ the funds.”

Save “found” money

Pre-commit to using a portion, like a third or half, said Dow, of any financial windfall such as a tax refund, job bonus or gifts to your emergency savings fund.

“Since there isn’t likely a budget for the extra funds, it doesn’t feel as painful as allocating everyday income,” she said. “Plus, you’re only using part of it, so you still use the rest for something you can enjoy more immediately.

Pick up a side gig

If you don’t have room in your budget to save, and you have the ability in your schedule, consider a part-time job to build your emergency savings. You don’t have to do it forever, but you can use the earnings from a side hustle to fund your emergency savings without touching your primary income for day-to-day expenses.

Make your money work for you

Take the time to review your portfolio.

“For example, if you have all of your money in a low-interest-rate savings account, you can help grow your money at a faster rate by putting it in a high-yield money market account or a CD,” suggested Sandra McPeak, managing director at Wells Fargo Advisors. “This can easily be done online or through a brokerage, and with automatic transfers, you won’t have a monthly hassle.”

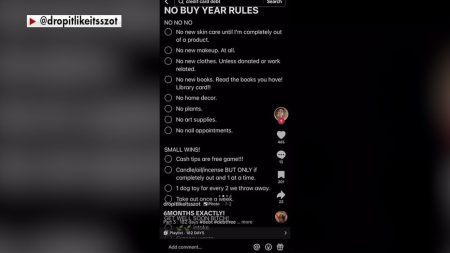

De-clutter your home

Incorporate a trash-to-treasure mindset, said McPeak. You can donate clothes, furniture, toys or even old vehicles to a nonprofit and be rewarded with a tax write-off, she said. Plus, you can try and sell your unwanted or unneeded items that are in good condition and deposit any proceeds in your emergency fund.

Read the full article here