Finance

For the first time in a decade, average credit scores have decreased slightly to 717, according to data released by FICO. In 2023, average scores sat at 718. This decline is likely due to high interest rates and inflation that are causing consumers to miss more payments and take on…

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. Borrowers…

About 85% of Americans live within five miles of a CVS Pharmacy, so chances are good that you have visited one before. But you might not know all the details of the CVS loyalty program. It has two tiers of membership: ExtraCare, which is free, and ExtraCare Plus, which costs…

Recently I wrote about the new Robinhood Gold Card. It pays 3% cash back on all purchases, making it one of the most valuable rewards credit cards available today. As I noted in the article, however, to qualify you must be a Robinhood Gold member, which costs $50 a year…

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. The…

The White House on Wednesday announced that President Biden has canceled another $1.2 billion in student loan debt for more than 150,000 borrowers earlier than expected. In an executive action that was originally planned for July, Biden has activated a Savings on Valuable Education (SAVE) plan policy that cancels debt…

One of the most important lessons regarding your finances to understand is to preserve and protect your credit score, as it can affect many directions and decisions throughout your life. “Your credit score is one of the most important numbers in your financial life; it goes a long way toward…

Interest payments for U.S. consumers are through the roof. Last quarter, consumers spent a record-high $1.1 trillion on interest payments alone, reported Quartz, using data from the U.S. Bureau of Economic Analysis (BEA). Over half of those interest payments were not related to mortgage debt. Mortgages often have some of…

An emergency fund should be a priority for Americans to be prepared for unforeseen and urgent expenses. Experts recommend you should have several months of living expenses saved that can be used for emergency situations. “We recommend having three to six months’ worth of expenses saved in an emergency savings…

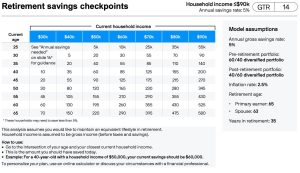

JP Morgan Asset Management recently released its 2024 Guide to Retirement. The guide attempts, among other things, to answer two important questions for those saving for retirement. First, it looks at how much one should have already saved for retirement based on their age and income. Second, it examined what…