Finance

The Biden administration is reportedly preparing to take a second crack at broad student loan forgiveness for millions of Americans after the Supreme Court struck down its first attempt. Citing people familiar, The Wall Street Journal reported Friday that the administration will roll out proposed regulations offering sweeping bailouts as…

Inflation – the change in overall prices – is back in the news again. After a persistent decline from a year over year high of 9.0% in June 2022 to a recent low of a year over year increase of 3.1% in January 2024, inflation recently has stopped falling. Prices…

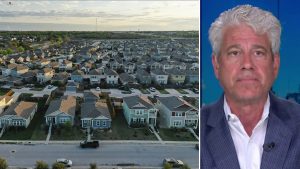

First-time homebuyers are likely to face more industry headwinds as mortgage rates and homeownership costs skyrocket in today’s economy. Mitch Roschelle, managing director at Madison Ventures+, said “it couldn’t be a worse time of year” as mortgage rates hit their highest level since November. “The timing is awful,” Roschelle stressed during…

Students throughout the country agree that student loan forgiveness is a must. An Axios survey founds that students on both sides of the political spectrum think the government should be doing more to help them pay off their debts. Of the 4,168 students surveyed, 89% of the Democratic students and…

Before its bankruptcy in 1991, Executive Life Insurance Company accepted transfer contracts from companies to pay their retirees’ pensions instead of the companies defined benefit pension plan. Employers saved money in the transfer because Executive Life offered high interest rates — which were discovered later to be backed by junk…

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. The…

During his “My Take,” Tuesday, “Varney & Co.” host Stuart Varney reacted to Biden’s pledge to make community college tuition-free, warning the president’s plan is part of a “political strategy” to win votes for the 2024 election. STUART VARNEY: Joe Biden is the giveaway president. He’s giving away your money. He’s…

Economic hardship is causing more people to rely on credit to cover living expenses, and some have even maxed out their credit cards to deal with inflation and rising prices, according to a recent survey. Credit card balances surged past the trillion dollar mark in the fourth quarter of 2023. The…

Many people know how Federal Reserve policies influence the economy and investment markets, but they don’t realize how interest rate moves change the results of estate planning strategies. The Federal Reserve increased rates significantly in 2022 and 2023, and recently market rates spikes again. The significant increases in rates the…

Mortgage rates continue their steady climb upward. Rates for 30-year mortgages averaged 6.88% this past week, Freddie Mac reported. Rates last week averaged 6.82%, and a year ago, the 30-year fixed-rate mortgage averaged 6.27%. “Mortgage rates have been drifting higher for most of the year due to sustained inflation and…